Understanding a Lot Owner Ledger in Strata Master Article 3

This article will review some ledger examples, in regard to determine how to cancel or reverse transactions. Review these as case studies.

Note that Lot ledgers are not to be issued to Lot Owners, se Current Owner Accounts from Formatted Reports.

Cancelling a receipt from some months prior because the receipt was meant for another lot.

1. You have found that Receipt #318 for $460.00 was not meant to be for this Lot, and needs to be cancelled.

Answer - Receipt #318 has been paid against levy 17 Quarterly levy dated 1/7/22. If you only cancel receipt #318, then levy 1/7/22 would be overdue and the Lot Owner would receive a debt recovery notice. You have 2 options, one longer but correct and one easier but not strictly correct or would making checking the ledger difficult. Option 1. Reverse receipt #339, then reverse receipt #324, then reverse receipt #318. Then re-receipt $1029.92 and $615.62 to this Lot, dating the receipts todays date (Do NOT backdate). Receipt $460 to the other Lot, once again date today, do NOT backdate. Option 2. Reverse only receipt #339, re-receipt only $171.24 to this Lot (631.24 - 460 ), and receipt $460.00 to the other Lot. This option would only be used where option 2 is not available, such as your attempt to cancel a receipt is met with messages from Strata Master prohibiting the cancellation of a receipt.

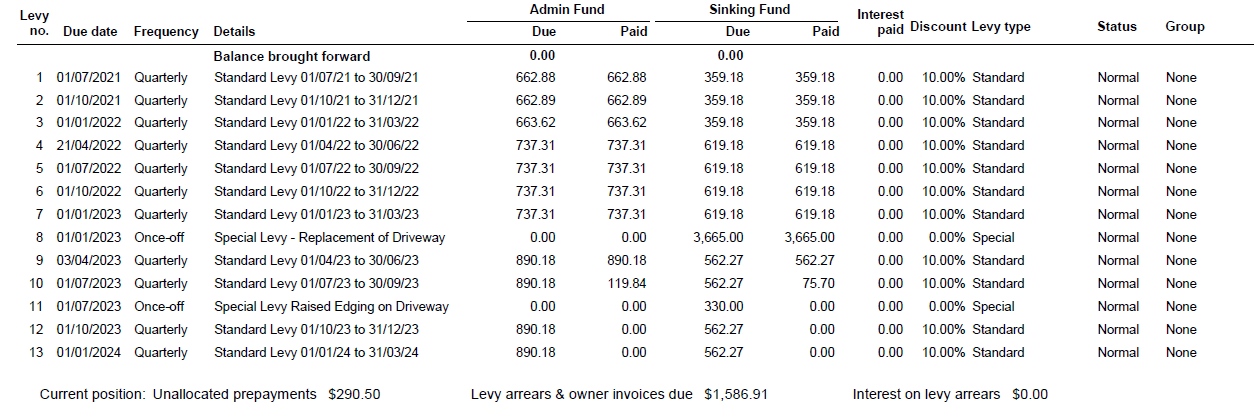

2. It is now 15/7/23 and the Levies due figure is $1586.91. Where does this figure come from?

Answer - Levies to an incl 3/4/2023 have been fully paid. Quarterly levy 1/7/23 has had $195.54 ($119.84 + $75.70) paid of the $1452.45 ($890.18 + $562.27) due, therefore still owes $1256.91, plus the Once off levy 1/7/23 of $330 is overdue. This provides a total of $1586.91. The levies posted for 1/10/23 and 1/1/24 are not yet due.

3. In the ledger above, what would be the effect on the ledger if you cancelled the Quarterly levy dated 3/4/23 to repost it as 1/4/23 ?

Answer - When a levy is cancelled, the funds paid against it will be auto allocated to the next levy posted. So in this case the $1452.45 paid would be allocated to the Once Off levy dated 1/7/23, then to the quarterly levy due 1/10/23, before you repost the levy dated 1/4/23. You would then need to cancel the auto allocation to those levies, so the funds will then allocate to unallocated funds. From there you can reallocate manually in the receipt screen to the newly posted levy for 1/4/23.

Alternatively, you can reverse the receipts applied to levies 10 and 9, before cancelling the levy. complete the transactions by re-receipting the reversed receipts.

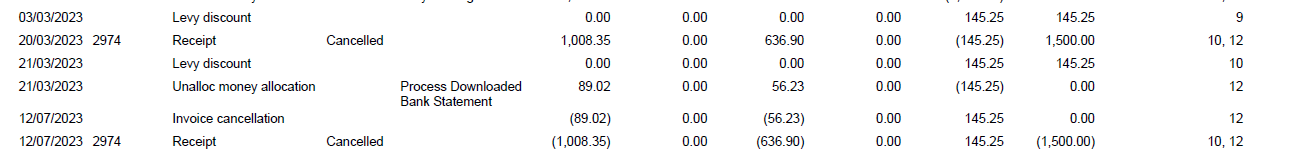

4. Assuming the unallocated figure on 1/3/23 was 0.00 (zero), what is the unallocated balance after receipt #2974 is cancelled on 12/7/23 ? Reminder - the unallocated column is the third from the right (the second from the right with figures). Receipt #2974 was initially receipted prior to 3/3/23.

Answer - 145.25 shows funds allocated to the unallocated fund. (145.25) shows funds removed from unallocated and applied to a levy or reversed. In this case, funds go in 3/3/23, out 20/3/23, in 21/3/23, out 21/3/23 , in 12/7/23 and in 12/7/23. Therefore the final total of unallocated is $290.50.