Allocating Unidentified Funds in a Single Trust in Strata Master

Summary

If you have a Single Trust covering all of your Strata Plans, your records and processing of unidentified funds will differ to that where Strata Plans (referred to as a Plan) have their own bank statements and records.

Where you have a Single Trust, the credit on a bank statement cannot be allocated to any particular Plan. The funds are then held in a record called Unidentified Money until it can be allocated to a particular Lot and Plan.

Note: These instructions also apply to Unclaimed Funds.

Overview

This article covers -

Reports Showing Unidentified Funds

Reallocate the Unidentified Funds

Reports Showing Unidentified Funds

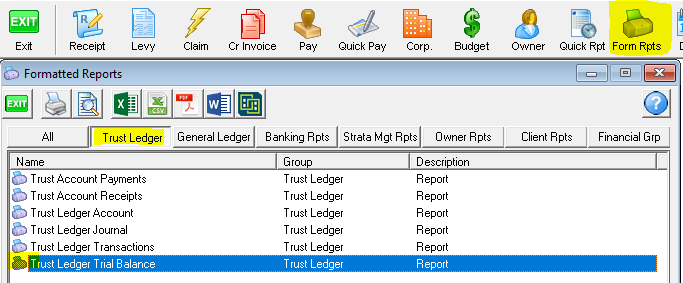

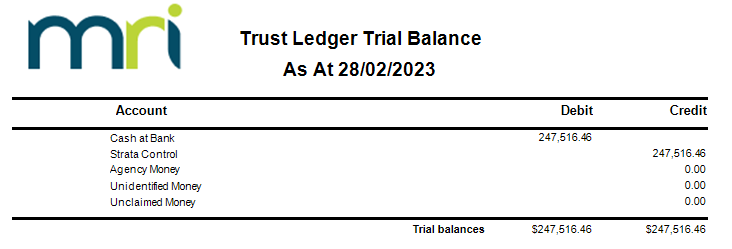

1. Navigate to Formatted Reports icon and select Trust Ledger Trial Balance

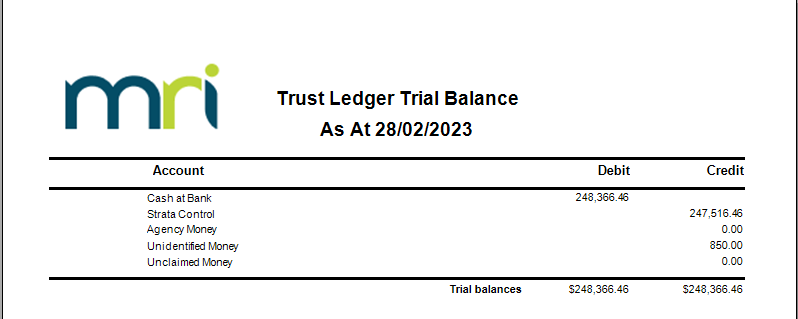

2. When the report opens you will see a balance beside Unidentified Money if there are any monies in that account.

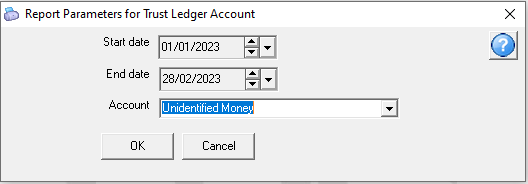

3. If you want to see whether that is a bulk figure of more than one entry or a single entry, you can refer to the Trust Ledger Account, selecting a date range and the Unidentified Money account

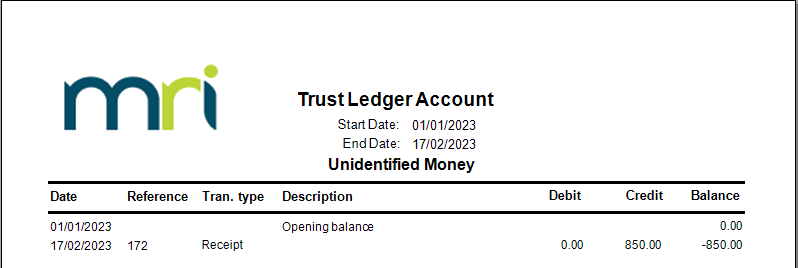

4. In this example, the ledger shows a balance of zero at the commencement of the search dates and one entry being receipt #172.

Reallocate the Unidentified Funds

As you cannot select a Plan to reverse a receipt, you can follow this process below to reverse the funds from Unidentified Money and then re-receipt the funds as required. Ensure that both the reversal and the receipt are dated today or both are backdated to the date of the original receipt.

1. Navigate to Accounting > Adjustments > Journal Entry and place the radio button on Trust Ledger.

2. Enter with a debit of Unidentified Money and credit of Cash at Bank. The logic here is that when reversing a receipt, you are reducing cash at bank records in Strata Master as you push the money back out. Cash at Bank is an asset (check your Chart of Accounts for this information) and assets are reduced with a credit. The other account is therefore the debit.

3. Click ok to the pop up

4. Check your Trail Balance to ensure the transaction has been processed correctly.

5. Re-receipt the funds as normal, allocating as relevant. Refer the Note below in regard to dating the receipt.

Note: Backdating receipts cancelled in 'search/cancel receipts' will usually duplicate balances in reports, because the reversal is not backdated. However in this case, the reversal above has been processed by journal and dated at the receipt date. This means that the receipt and the reversal of that receipt are the same date. If you re-receipt at that same date, there is no duplication of the funds to adversely affect cash at bank/bank reconciliation. |