Reversing a Status Report Fee Receipt in Strata Master

Should a Conveyancer/Solicitor or a Lot Owner pay a Fee for a Status Report (Certificate) twice, you will have a duplicate receipt. You will be asked to refund the duplicate payment.

Since receipting to account 146500 Status Certificate Fee triggers a charge by your Agency to the Owner Corporation, there are possibly other steps in addition to reversing the receipt.

If a duplicate receipt has been processed, then a duplicate charge in Management Fees will also trigger.

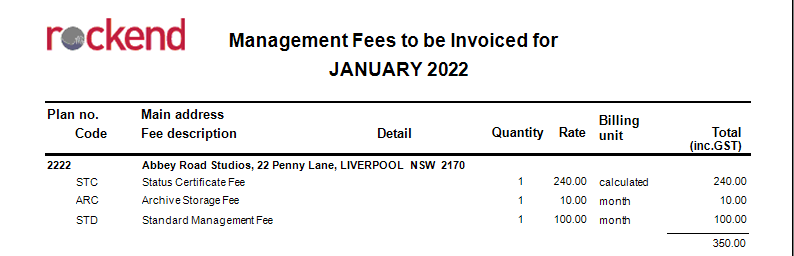

The Management Fee

The fee for Status Reports does not process through Quantity Management Fees but through the same channels as the Standard Monthly Management Fee.

The fee charged will show on the Management Fees preview the day after receipting.

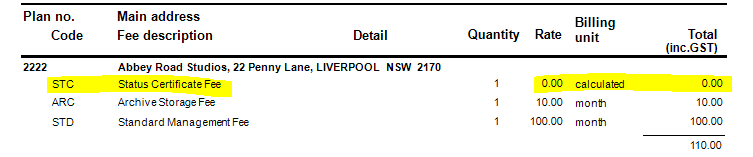

If you are able to see the duplicate Fee on the Management report preview, the cancellation of the receipt will not reflect in the Management Fee report until the next day when the date on the workstation progresses.

The next day after reversing the duplicate receipt, your Management Report will appear similar to below, with the Status Certificate Fee being zero or having reduced by 1 fee.

Reversing the Receipt

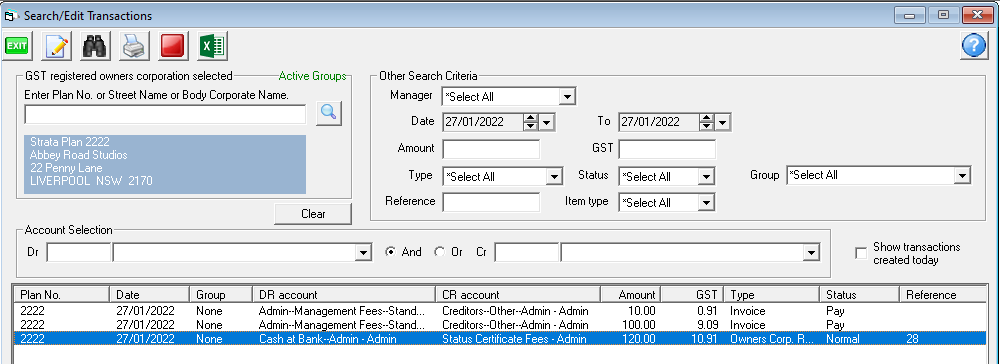

1. Go to Accounting > Adjustments > Search/edit transactions and enter filters to locate the Ref Number (Receipt number). The receipt number in the screenshot below is 28.

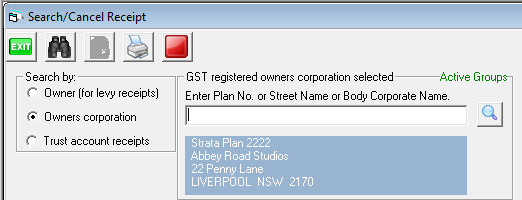

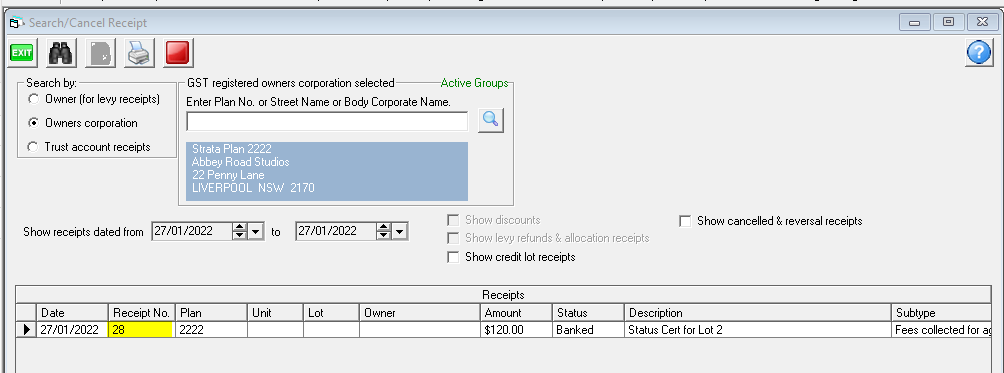

2. Go to Accounting > Adjustments > Search/Cancel Receipts > change the radio button to 'Owners Corporation' and enter the required Plan number.

3. Enter date range and click the search button

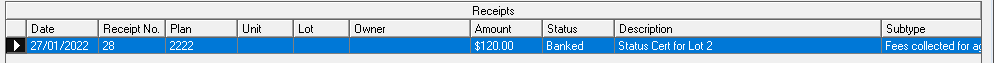

4. Locate the receipt, highlight the whole line to be a blue colour.

5. Click the cancel button.

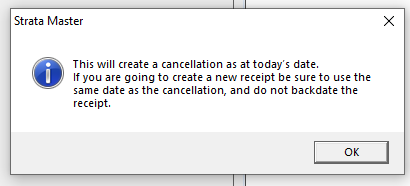

6. Note the caution to NOT backdate receipts if you are going to re-receipt, click ok.

7. Enter reason for cancelling the receipt and click ok.

8. Once you have reversed the receipt, you will need to return the funds to the payer, usually being a Conveyancer or a Lot Owner.

You can do this by making a payment direct from the bank website, since you now have not receipted the funds, or more correctly and preferred by Auditors, is to receipt the funds to a Suspense account or Miscellaneous Income, and then make a Quick pay payment from that selected account to the payer. Link to Quick Pay instruction is here - https://kb.rockend.com/help/payments-by-quick-pay-strata-master

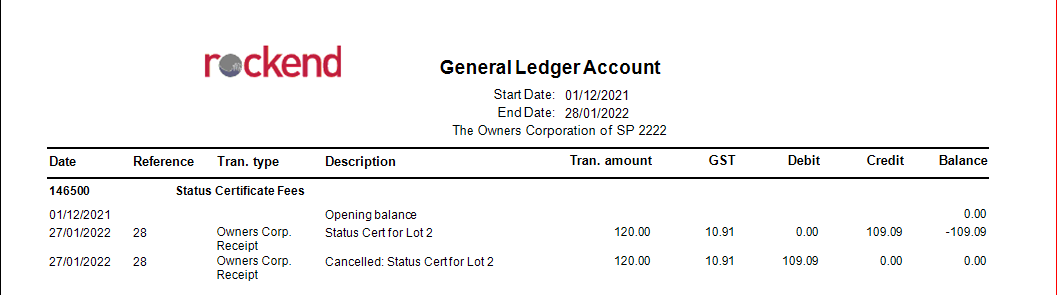

The General Ledger Account

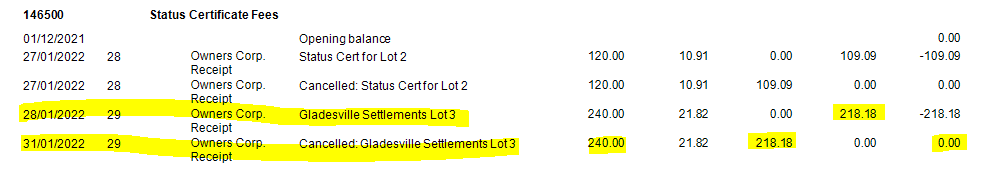

Checking the General Ledger Account for 146500, you will see a Credit when the funds are receipted (increase revenue) and a debit for the cancellation of the receipt (decrease revenue).

What if Management Fees have already been processed?

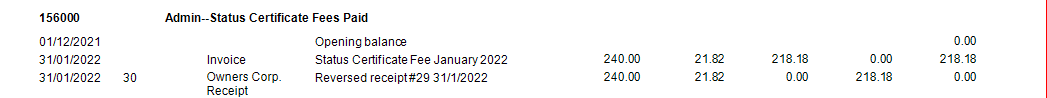

1. Checking the General Ledger, you will see that the revenue account 146500 entry is automatically reversed when the receipt is cancelled, as this is where the receipt is recorded.

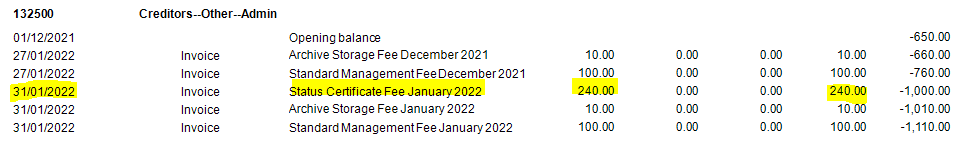

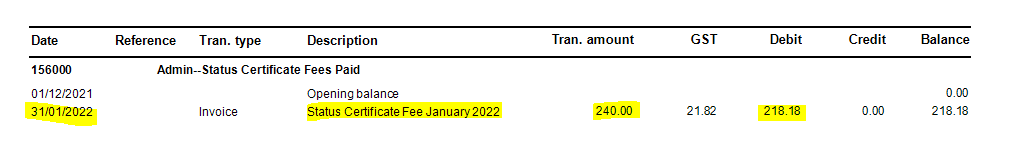

2. However the Management Fee, when processed through Accounting > Invoice Management Fees then is passed to Creditors. This is not linked to the receipt so is not automatically reversed. It remains as a Credit in Creditors Other 132500 and a debit in expense account Status Certificate Fees Paid 156000.

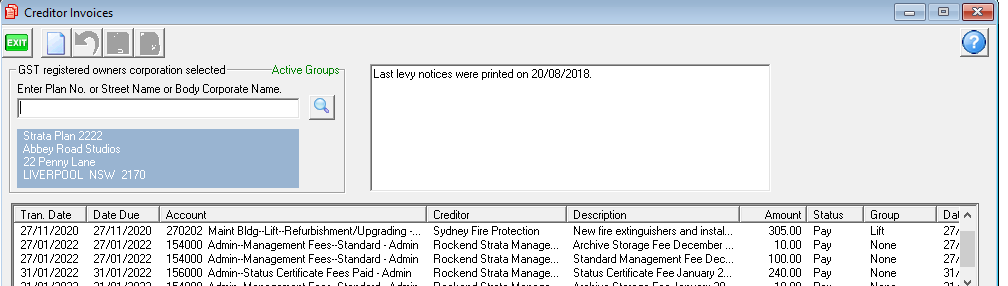

3. It can also be seen in Creditors screen until paid through a Creditors run.

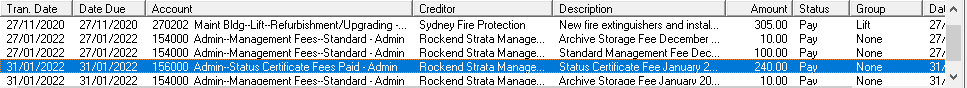

4. To remove the Fee to the Owners Corporation for the reversed receipt, highlight the Creditor Invoice.

5. Then click the Cancel button.

6. If you have already run the Creditors and your Agency has received the funds, you will need to have the funds returned back to the trust account. When the funds show on the bank statement you can receipt the funds, selecting account 156000. This will create a debit to cash at bank (to increase cash) and credit to account 156000 (to reduce the expense), thereby negating the previous debit to account 156000.

Useful Links

https://kb.rockend.com/help/payments-by-quick-pay-strata-master

For steps to locate and access the General Ledger - https://kb.rockend.com/help/how-to-create-or-enter-a-journal