GST On Opening Balances in Strata Master

VERY IMPORTANT NOTE -

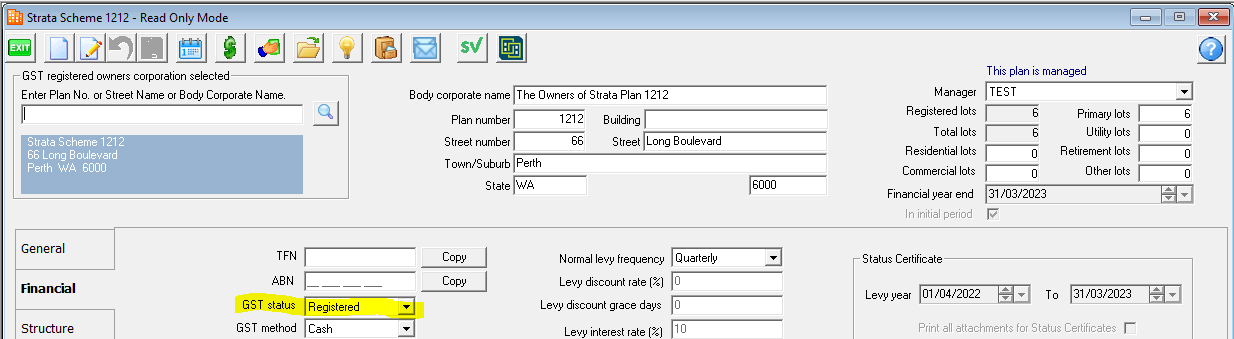

GST on opening balances only affects Plans that are GST registered, so prior to entering Opening Balances ensure that you have the correct setting in the Corp screen > Financial Tab otherwise you would have to undo all your opening balances and re-enter.

This process of undoing previous entries and re-entering would probably entail the engagement of a Consultant to assist, at extra charge, as Support can only provide basic guidelines for you in this lengthy and complex circumstance.

How Entries on the Levies Tab Affect the GST

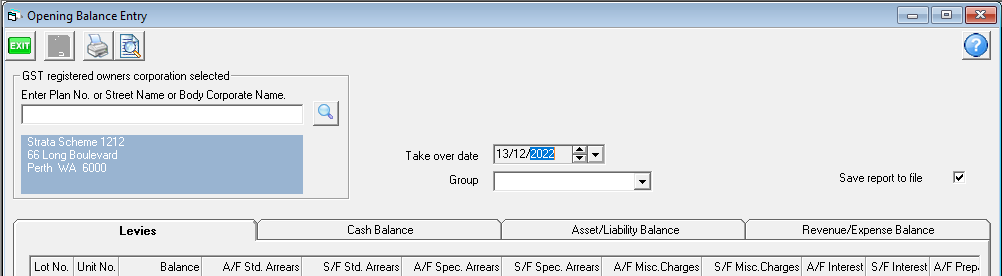

1. In this example we have entered arrears, interest, prepaid figures and Misc Charges (Owner invoices) to the new Plans opening Balances Levies Tab. We have not entered a group.

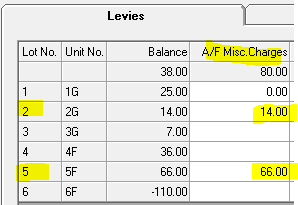

2. Scroll to the right of the Levies tab and you see the GST columns prefill automatically. Do not manually enter any figures in these columns.

3. If you check the Lot entries, you will notice that the only Lots that show GST figures ($1.27 and $6.00) are Lots 2 and 5 which those with entries in the Misc Charges column.

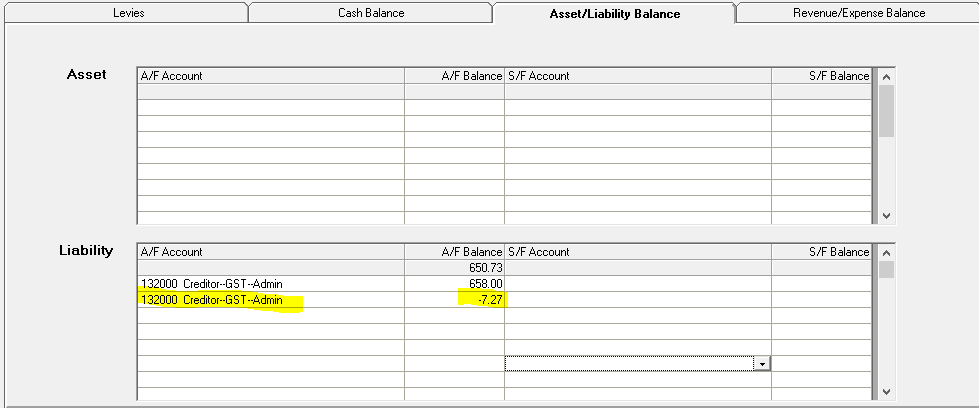

4. When entering the figures to the Assets/Liability tab (Balance Sheet) you will enter the amount of accrued GST liability from the previous manager's provided Balance Sheet, in this case $658.00. As Strata Master is also going to include GST liability in the transactions from the Levies tab, you will then deduct the amount from the GST column in Step 2 above, being $7.27 in this example.

Once the Admin figure is entered, you will follow the same process with the Sinking Fund.

5. The net balance of gst, in the example above is $650.73 for Admin, is the figure that will be processed to the gst account in addition to the gst included in the Levies tab, making a total of $658.00.

6. If you follow the steps above and still have queries, then please log a support call. We will endeavour to assist you.

Note that if you have taken over a Plan that was previously managed on paper records, or without Balance Sheets, or from another platform other than Strata Master, Strata Master Support staff cannot interpret the previous agents reports for you. We can discuss possibilities but are not permitted tell you what figure to put where unless it is clearly worded in the reports. The interpretation of the take on reports is ultimately your decision.

GST On Reports

Note that some reports figures are gst exclusive. When receiving reports from another agent and the software used is unfamiliar, you will need to do your own checks to determine whether their figures are gst inclusive or gst exclusive.

If there is a figure in the gst account/s, and your Plan is not registered for gst, check with the prior agent or Tax Office whether there has been a recent gst liability change, as the gst could have accrued during a prior period and may still be payable.

This is not an issue if the plan is not registered for gst and there is no gst figure in the reports.

GST Training

GST training is available through our Education Section and highly recommended. Contact them through our website https://www.mrisoftware.com/au/training-academy/ or through email Education.APAC@mrisoftware.com